DEF 14A: Definitive proxy statements

Published on April 18, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

|

Filed by the Registrant

|

[X]

|

|

Filed by a Party other than the Registrant

|

[ ]

|

|

Check the appropriate box:

|

|

[ ]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[X]

|

Definitive Proxy Statement

|

|

[ ]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to Section 240.14a-12

|

BIORESTORATIVE THERAPIES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

[X]

|

No fee required

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

1)

|

Title of each class of securities to which transaction applies:

not applicable

|

|

2)

|

Aggregate number of securities to which transaction applies:

not applicable

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined):

not applicable

|

|

4)

|

Proposed maximum aggregate value of transaction:

not applicable

|

|

5)

|

Total fee paid:

not applicable

|

|

[ ]

|

Fee paid previously with preliminary materials:

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

1)

|

Amount previously paid:

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

3)

|

Filing Party:

|

|

4)

|

Date Filed:

|

BIORESTORATIVE THERAPIES, INC.

40 Marcus Drive, Suite One

Melville, New York 11747

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 30, 2019

To the Stockholders of BioRestorative Therapies, Inc.:

NOTICE IS HEREBY GIVEN

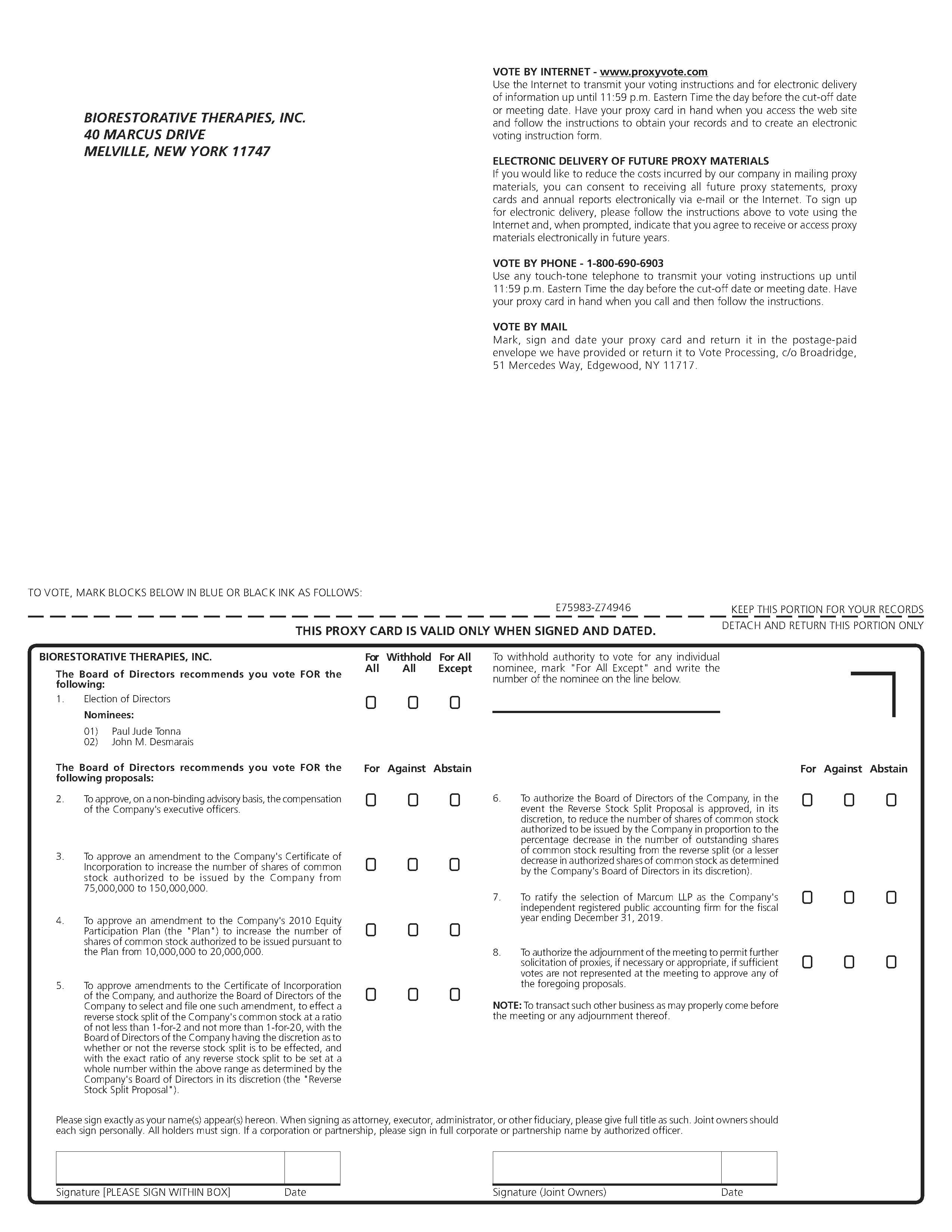

that the Annual Meeting of Stockholders of BioRestorative Therapies, Inc., a Delaware corporation (the “Company”), will be held on May 30, 2019 at 90 Merrick Avenue, 9th Floor, East Meadow, New York, at 4:00 p.m., local time, for the

following purposes:

|

1.

|

To elect two Class II directors to hold office until the 2022 Annual Meeting of Stockholders.

|

|

2.

|

To hold a non-binding advisory vote on the Company’s executive compensation.

|

|

3.

|

To amend the Company’s Certificate of Incorporation to increase the number of authorized shares of common stock from 75,000,000 to

150,000,000.

|

|

4.

|

To approve an amendment to the Company’s 2010 Equity Participation Plan (the “Plan”) to increase the number of shares of common

stock authorized to be issued pursuant to the Plan from 10,000,000 to 20,000,000.

|

|

5.

|

To approve amendments to the Certificate of Incorporation of the Company, and authorize the Board of Directors of the Company to

select and file one such amendment, to effect a reverse stock split of the Company’s common stock at a ratio of not less than 1-for-2 and not more than 1-for-20, with the Board of Directors of the Company having the discretion as to

whether or not the reverse stock split is to be effected, and with the exact ratio of any reverse stock split to be set at a whole number within the above range as determined by the Company’s Board of Directors in its discretion (the

“Reverse Stock Split Proposal”).

|

|

6.

|

To authorize the Board of Directors of the Company, in the event the Reverse Stock Split Proposal is approved, in its discretion,

to reduce the number of shares of common stock authorized to be issued by the Company in proportion to the percentage decrease in the number of outstanding shares of common stock resulting from the reverse split (or a lesser decrease in

authorized shares of common stock as determined by the Company’s Board of Directors in its discretion) (the “Authorized Shares Proposal”).

|

|

7.

|

To ratify the selection of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending

December 31, 2019.

|

|

8.

|

To authorize the adjournment of the meeting to permit further solicitation of proxies, if necessary or appropriate, if sufficient

votes are not represented at the meeting to approve any of the foregoing proposals.

|

|

9.

|

To transact such other business as may properly come before the meeting.

|

Only stockholders of record at the close of business on April 2, 2019 are entitled to notice of and to vote at the meeting

or at any adjournment thereof.

Important

notice regarding the availability of Proxy Materials: The proxy statement and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 are available electronically to the Company’s stockholders of record as of

the close of business on April 2, 2019 at www.proxyvote.com.

Mark Weinreb

Chief Executive Officer

Melville, New York

April 18, 2019

|

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE.

FOR SPECIFIC INSTRUCTIONS ON HOW TO VOTE YOUR SHARES, PLEASE REFER TO THE INSTRUCTIONS ON THE NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS YOU RECEIVED IN THE MAIL OR, IF YOU REQUESTED TO RECEIVE PRINTED PROXY MATERIALS, YOUR

ENCLOSED PROXY CARD. ANY STOCKHOLDER MAY REVOKE A SUBMITTED PROXY AT ANY TIME BEFORE THE MEETING BY WRITTEN NOTICE TO SUCH EFFECT, BY SUBMITTING A SUBSEQUENTLY DATED PROXY OR BY ATTENDING THE MEETING AND VOTING IN PERSON. THOSE VOTING BY

INTERNET OR BY TELEPHONE MAY ALSO REVOKE THEIR PROXY BY VOTING IN PERSON AT THE MEETING OR BY VOTING AND SUBMITTING THEIR PROXY AT A LATER TIME BY INTERNET OR BY TELEPHONE.

|

BIORESTORATIVE THERAPIES, INC.

40 Marcus Drive, Suite One

Melville, New York 11747

____________________________

PROXY STATEMENT

____________________________

SOLICITING, VOTING AND REVOCABILITY OF PROXY

This proxy statement is being mailed or made available to all stockholders of record at the close of

business on April 2, 2019 in connection with the solicitation by our Board of Directors of proxies to be voted at the 2019 Annual Meeting of Stockholders to be held on May 30, 2019 at 4:00 p.m., local time, or any adjournment thereof. Proxy

materials for the 2019 Annual Meeting of Stockholders were mailed or made available to stockholders on or about April 18, 2019.

All shares represented by proxies duly executed and received will be voted on the matters presented

at the meeting in accordance with the instructions specified in such proxies. Proxies so received without specified instructions will be voted as follows:

|

(i)

|

FOR the nominees named in the

proxy to our Board of Directors.

|

|

|

(ii)

|

FOR the approval of the

compensation of our named executive officers.

|

|

|

(iii)

|

FOR the proposal to amend our

Certificate of Incorporation to increase the number of authorized shares of common stock from 75,000,000 to 150,000,000.

|

|

|

(iv)

|

FOR the proposal to approve an

amendment to our 2010 Equity Participation Plan (the “Plan”) to increase the number of shares of common stock authorized to be issued pursuant to the Plan from 10,000,000 to 20,000,000.

|

|

|

(v)

|

FOR the proposal to approve

amendments to our Certificate of Incorporation, and the authorization of our Board of Directors to select and file one such amendment, to effect a reverse stock split of our common stock at a ratio of not less than 1-for-2 and not more than

1-for-20, with our Board of Directors having the discretion as to whether or not the reverse stock split is to be effected, and with the exact ratio of any reverse stock split to be set at a whole number within the above range as determined

by our Board of Directors in its discretion (the “Reverse Stock Split Proposal”).

|

|

|

(vi)

|

FOR the proposal to authorize

our Board of Directors, in the event the Reverse Stock Split Proposal is approved, in its discretion, to reduce the number of shares of common stock authorized to be issued by us in proportion to the percentage decrease in the number of

outstanding shares of common stock resulting from the reverse split (or a lesser decrease in authorized shares of common stock as determined by our Board of Directors in its discretion) (the “Authorized Shares Proposal”).

|

|

3

|

|

|

|

(vii)

|

FOR the ratification of the

selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019.

|

|

(viii)

|

FOR the proposal to adjourn

the meeting to permit further solicitation of proxies, if necessary or appropriate, if sufficient votes are not represented at the meeting to approve any of the foregoing proposals.

|

If you are a beneficial owner of shares held in street name and you do not provide specific voting instructions to the

organization that holds your shares, the organization will be prohibited under the current rules of the New York Stock Exchange from voting your shares on “non-routine” matters. This is commonly referred to as a “broker non-vote”. Proposals 3, 5, 6

and 7 are each considered a routine matter. Each remaining proposal is considered a “non-routine” matter and therefore may not be voted on by your bank or broker absent specific instructions from you. Please instruct your bank or broker so your

vote can be counted.

Our Board does not know of any other matters that may be brought before the meeting nor does it

foresee or have reason to believe that the proxy holder will have to vote for a substitute or alternate nominee to the Board. In the event that any other matter should come before the meeting or either nominee is not available for election, the

person named in the enclosed proxy will have discretionary authority to vote all proxies not marked to the contrary with respect to such matters in accordance with his best judgment.

The total number of shares of common stock outstanding and entitled to vote as of the close of

business on April 2, 2019 was 14,946,874. The shares of common stock are the only class of securities entitled to vote on matters presented to our stockholders, each share being entitled to one vote. The holders of one-third of the shares of

common stock outstanding as of the close of business on April 2, 2019, or 4,982,292 shares of common stock, must be present at the meeting in person or by proxy in order to constitute a quorum for the transaction of business.

With regard to the election of directors, votes may be cast in favor or withheld. The directors shall

be elected by a plurality of the votes cast in favor. Accordingly, based upon there being two nominees, each person who receives one or more votes will be elected as a director. Shares of common stock as to which a stockholder withholds voting

authority in the election of directors and broker non-votes will not be counted as voting thereon and therefore will not affect the election of the nominees receiving a plurality of the votes cast.

Stockholders may expressly abstain from voting on Proposals 2, 3, 4, 5, 6, 7 and 8 by so indicating

on the proxy. Abstentions are counted as present in the tabulation of votes on Proposals 2, 3, 4, 5, 6, 7 and 8. Since Proposals 3, 5 and 6 require the affirmative approval of a majority of the shares of common stock outstanding and entitled to

vote (assuming a quorum is present at the meeting), abstentions will have the effect of a negative vote. Since Proposals 2, 4, 7 and 8 require the affirmative approval of a majority of the shares of common stock present in person or represented by

proxy at the meeting and entitled to vote (assuming a quorum is present at the meeting), abstentions will have the effect of a negative vote while broker non-votes will have no effect.

4

Any person giving a proxy in the form accompanying this proxy statement has the power to revoke it at

any time before its exercise. The proxy may be revoked by filing with us written notice of revocation or a fully executed proxy bearing a later date. The proxy may also be revoked by affirmatively electing to vote in person while in attendance at

the meeting. However, a stockholder who attends the meeting need not revoke a proxy given and vote in person unless the stockholder wishes to do so. Written revocations or amended proxies should be sent to us at 40 Marcus Drive, Suite One,

Melville, New York 11747, Attention: Corporate Secretary. Those voting by Internet or by telephone may also revoke their proxy by voting in person at the meeting or by voting and submitting their proxy at a later time by Internet or by telephone.

The proxy is being solicited by our Board of Directors. We will bear the cost of the solicitation of

proxies, including the charges and expenses of brokerage firms and other custodians, nominees and fiduciaries for forwarding proxy materials to beneficial owners of our shares. Solicitations will be made primarily by Internet availability of proxy

materials and by mail, but certain of our directors, officers or employees may solicit proxies in person or by telephone, fax or email without special compensation.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following Summary Compensation Table sets forth all compensation earned in all capacities during the fiscal years

ended December 31, 2018 and 2017 by (i) our principal executive officer, (ii) our two most highly compensated executive officers, other than our principal executive officer, who were serving as executive officers as of December 31, 2018 and whose

total compensation for the 2018 fiscal year, as determined by Regulation S-K, Item 402, exceeded $100,000, and (iii) a person who would have been included as one of our two most highly compensated executive officers, other than our principal

executive officer, but for the fact that he was not serving as one of our executive officers as of December 31, 2018 (the individuals falling within categories (i), (ii) and (iii) are collectively referred to as the “Named Executive Officers”):

|

Name and Principal

Position

|

|

Year

|

|

|

Salary

|

|

|

Bonus (1)

|

|

|

Option

Awards

Earned (2)

|

|

|

All

Other

Compensation

|

|

|

Total

|

|

||||||

|

Mark Weinreb,

|

|

|

2018

|

|

|

$

|

400,000

|

|

|

$

|

-

|

|

$

|

291,800

|

(3)

|

|

$

|

7,200

|

(4)

|

|

$

|

699,000

|

(4)

|

|

|

Chief Executive Officer

|

|

|

2017

|

|

|

$

|

400,000

|

|

|

$

|

32,000

|

|

$

|

784,700

|

(5)

|

|

$

|

7,200

|

(6)

|

|

$

|

1,223,900

|

(6)

|

|

|

Adam Bergstein

|

|

|

2018

|

|

|

$

|

264,538

|

|

|

$

|

-

|

|

$

|

1,491,300

|

(7)

|

|

$

|

-

|

|

|

$

|

1,755,838

|

|

|

|

Senior VP, Planning and Business Development(8)

|

|

2017

|

|

|

$

|

-

|

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

|

$

|

-

|

|

|||

|

Francisco Silva,

|

|

|

2018

|

|

|

$

|

287,500

|

|

|

$

|

23,000

|

|

$

|

107,800

|

(9)

|

|

$

|

-

|

|

|

$

|

418,300

|

|

|

|

VP, Research and Development

|

|

|

2017

|

|

|

$

|

250,000

|

|

|

$

|

6,000

|

|

$

|

200,400

|

(10)

|

|

$

|

-

|

|

|

$

|

456,400

|

|

|

|

Robert Paccasassi,

|

|

|

2018

|

|

|

$

|

201,250

|

|

|

$

|

32,703

|

|

$

|

53,900

|

(11)

|

|

$

|

-

|

|

|

$

|

287,853

|

|

|

|

VP, Quality and Compliance(12)

|

|

|

2017

|

|

|

$

|

-

|

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

|

$

|

-

|

|

||

___________________

|

(1)

|

Represents bonus amounts earned pursuant to the achievement of certain performance goals.

|

|

(2)

|

The amounts reported in this column represent the grant date fair value of the option awards granted during the years ended

December 31, 2018 and 2017, calculated in accordance with FASB ASC Topic 718. For a detailed discussion of the assumptions used in estimating fair values, see Note 10 – Stockholders' Deficiency in the notes that accompany our

consolidated financial statements included in our Annual Report for the fiscal year ended December 31, 2018 incorporated into this proxy statement by reference.

|

5

|

(3)

|

During 2018, Mr. Weinreb was granted a ten-year option under the Plan for the purchase of 275,000 shares of

common stock at an exercise price of $1.23 per share. Such option is exercisable to the extent of 91,667 shares as of each of the date of grant and the first anniversary of the date of grant and 91,666 shares as of the second

anniversary of the date of grant. See "Employment Agreements" below for a discussion of certain provisions relating to the options granted to Mr. Weinreb.

|

|

(4)

|

Of the aggregate $699,000 earned during 2018, $291,800 represents the grant date value of non-cash stock-based

compensation awards, irrespective of the vesting period of those awards. Of the $407,200 earned cash compensation, $406,761and $439 were paid in cash during 2018 and 2019 (prior to the date of the filing of this proxy statement),

respectively, and none remains unpaid for 2018. All Other Compensation represents an automobile allowance paid to Mr. Weinreb in 2018.

|

|

(5)

|

During 2017, Mr. Weinreb was granted a ten-year option under the Plan for the purchase of 275,000 shares of

common stock at an exercise price of $3.35 per share. Such option is exercisable to the extent of 91,667 shares as of each of the date of grant and the first anniversary of the date of grant and 91,666 shares as of the second

anniversary of the date of grant. See “Employment Agreements” below for a discussion of certain provisions relating to the options granted to Mr. Weinreb.

|

|

(6)

|

Of the aggregate $1,223,900 earned during 2017, $784,700 represents the grant date value of non-cash

stock-based compensation awards, irrespective of the vesting period of those awards. Of the $439,200 earned cash compensation, $178,113 and $261,087 were paid in cash during 2017 and 2018, respectively, and none remains unpaid for 2017.

All Other Compensation represents an automobile allowance paid to Mr. Weinreb in 2017.

|

|

(7)

|

During 2018, Mr. Bergstein was granted a ten-year option under the Plan for the purchase of 500,000 shares of

common stock at an exercise price of $3.40 per share. Such option was exercisable upon the satisfaction of a certain condition. As a result of Mr. Bergstein’s resignation on October 28, 2018, such option has terminated.

|

|

(8)

|

Mr. Bergstein resigned as an officer on October 28, 2018.

|

|

(9)

|

During 2018, Mr. Silva was granted a ten-year option under the Plan for the purchase of 100,000 shares of

common stock at an exercise price of $1.23 per share. Such option is exercisable to the extent of 33,334 shares as of the first anniversary of the date of the grant and 33,333 shares as of each of the second and third anniversaries of

the date of grant.

|

|

(10)

|

During 2017, Mr. Silva was granted a ten-year option under the Plan for the purchase of 80,000 shares of common

stock at an exercise price of $2.80 per share. Such option is exercisable to the extent of 26,667 shares as of each of the first and second anniversaries of the date of grant and 26,666 shares as of the third anniversary of the date of

grant.

|

6

|

(11)

|

During 2018, Mr. Paccasassi was granted a ten-year option under the Plan for the purchase of 50,000 shares of

common stock at an exercise price of $1.23 per share. Such option is exercisable to the extent of 16,667 shares as of each of the first and second anniversaries of the date of grant and 16,666 shares as of the third anniversary of the

date of grant.

|

|

(12)

|

Mr. Paccasassi was not a Named Executive Officer during 2017.

|

Employment Agreements

In March 2015, we entered into an employment agreement with Mark Weinreb, our Chief Executive Officer. Pursuant to the

employment agreement, which expires on December 31, 2019, Mr. Weinreb is entitled to receive a salary of $400,000 per annum. Mr. Weinreb was entitled to receive an annual bonus for 2015 equal to 50% of his annual base salary and was entitled to

receive an annual bonus for 2016, 2017 and 2018 of up to 40%, 50% and 50%, respectively, of his annual base salary, in the event certain performance goals, as determined by our Compensation Committee, were satisfied. Mr. Weinreb is entitled to

receive an annual bonus for 2019 of up to 50% of his annual base salary in the event certain performance goals, as determined by our Compensation Committee, are satisfied. Pursuant to the employment agreement, in the event that Mr. Weinreb's

employment is terminated by us without "cause", or Mr. Weinreb terminates his employment for "good reason" (each as defined in the employment agreement), Mr. Weinreb would be entitled to receive severance in an amount equal to one time his then

annual base salary and certain benefits, plus $100,000 (in lieu of bonus). In addition, pursuant to the employment agreement, Mr. Weinreb would be entitled to receive such severance in the event that the term of his employment agreement is not

extended beyond December 31, 2019 and, within three months of such expiration date, his employment is terminated by us without "cause" or if Mr. Weinreb terminates his employment for any reason. Further, in the event that Mr. Weinreb's employment

is terminated by us without "cause", or Mr. Weinreb terminates his employment for "good reason", following a "change in control" (as defined in the employment agreement), Mr. Weinreb would be entitled to receive severance in an amount equal to one

and one-half times his then annual base salary and certain benefits, plus $300,000 (in lieu of bonus). Pursuant to the employment agreement, with respect to options granted to Mr. Weinreb during the term of his employment with us, such options

shall vest and become exercisable if Mr. Weinreb is entitled to receive severance based upon a termination of his employment as set forth above. In addition, pursuant to the employment agreement, to the extent that an option granted to Mr. Weinreb

during his term of his employment with us becomes exercisable (whether due to the passage of time or otherwise), such option shall remain exercisable until its expiration date notwithstanding any termination of employment with us.

Effective January 16, 2018, we entered into an at will employment agreement with Adam D. Bergstein,

Senior Vice President, Planning and Business Development. Pursuant to the employment agreement, Mr. Bergstein was entitled to receive a base annual salary of $250,000 during the initial three months of employment. Thereafter, his base salary

increased to $350,000. In addition, pursuant to the employment agreement, Mr. Bergstein was entitled to receive an annual bonus of up to 30% of his annual salary based on the satisfaction of certain performance goals. The employment agreement

also provided for the payment of three months severance under certain circumstances. Mr. Bergstein resigned his employment with us effective October 28, 2018.

7

Effective April 5, 2011, we entered into an at will employment agreement with Francisco Silva, our

Vice President of Research and Development. Pursuant to the employment agreement, as amended, Mr. Silva is currently entitled to receive a salary of $287,500 per annum. In addition, pursuant to the employment agreement, as amended, Mr. Silva is

entitled to receive an annual bonus of up to 20% of his annual salary (up to 16% of his annual salary for 2016) based on the satisfaction of certain performance goals. Further, pursuant to the employment agreement, as amended, in the event that

Mr. Silva’s employment with us is terminated without cause, Mr. Silva would be entitled to receive severance in an amount equal to 50% of his then annual base salary.

Effective September 2, 2015, we entered into an at will employment agreement with Robert Paccasassi,

our Vice President of Quality and Compliance. Pursuant to the employment agreement, as amended, Mr. Paccasassi is currently entitled to receive a salary of $201,250 per annum. In addition, pursuant to the employment agreement, Mr. Paccasassi is

entitled to receive an annual bonus of up to 25% of his annual salary based upon the satisfaction of certain performance goals.

Outstanding Equity Awards at Fiscal Year-End

The following table provides information on outstanding equity awards as of December 31, 2018 to the Named Executive

Officers:

|

|

|

Option Awards

|

|

Stock Awards

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

incentive

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

plan

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

awards:

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

incentive

|

|

|

Market or

|

|

||||||||

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

plan

|

|

|

payout

|

|

||||||||

|

|

|

|

|

|

|

|

|

incentive

|

|

|

|

|

|

|

|

|

|

|

|

|

|

awards:

|

|

|

value of

|

|

||||||||

|

|

|

|

|

|

|

|

|

plan awards:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of

|

|

|

unearned

|

|

||||||||

|

|

|

Number of

|

|

|

Number of

|

|

|

Number of

|

|

|

|

|

|

|

|

Number

|

|

|

Market

|

|

|

unearned

|

|

|

shares,

|

|

||||||||

|

|

|

securities

|

|

|

securities

|

|

|

securities

|

|

|

|

|

|

|

|

of shares

|

|

|

value of

|

|

|

shares,

|

|

|

units or

|

|

||||||||

|

|

|

underlying

|

|

|

underlying

|

|

|

underlying

|

|

|

|

|

|

|

|

or units of

|

|

|

shares of

|

|

|

units or

|

|

|

other

|

|

||||||||

|

|

|

unexercised

|

|

|

unexercised

|

|

|

unexercised

|

|

|

Option

|

|

|

Option

|

|

stock that

|

|

|

units

|

|

|

other rights

|

|

|

rights

|

|

||||||||

|

|

|

options

|

|

|

options

|

|

|

unearned

|

|

|

exercise

|

|

|

expiration

|

|

have not

|

|

|

that have

|

|

|

that have

|

|

|

that have

|

|

||||||||

|

Name

|

|

exercisable

|

|

|

unexercisable

|

|

|

options

|

|

|

price (1)

|

|

|

date

|

|

vested

|

|

|

not vested

|

|

|

not vested

|

|

|

not vested

|

|

||||||||

|

Mark Weinreb

|

|

|

4,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

12/14/2020

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Weinreb

|

|

|

50,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

2/10/2022

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Weinreb

|

|

|

20,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

12/7/2022

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Weinreb

|

|

|

12,500

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

10/4/2023

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Weinreb

|

|

|

50,000

|

|

|

|

-

|

|

|

-

|

|

|

$

|

4.70

|

|

|

2/18/2024

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Weinreb

|

|

|

150,000

|

|

|

|

-

|

|

|

-

|

|

|

$

|

4.70

|

|

|

10/23/2024

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

Mark Weinreb

|

208,000

|

-

|

-

|

$

|

4.70

|

9/4/2025

|

-

|

$

|

-

|

-

|

$

|

-

|

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Mark Weinreb

|

275,000

|

-

|

-

|

$

|

3.73

|

6/10/2026

|

-

|

$

|

-

|

-

|

$

|

-

|

||||||||||||||||||||||

|

Mark Weinreb

|

183,334

|

91,666

|

(2) |

-

|

$

|

3.35

|

6/23/2027

|

-

|

$

|

-

|

-

|

$

|

-

|

|||||||||||||||||||||

|

Mark Weinreb

|

91,667

|

183,333

|

(3)

|

-

|

$

|

1.23

|

10/29/2028

|

-

|

$

|

-

|

-

|

$

|

-

|

|||||||||||||||||||||

8

|

Adam D. Bergstein

|

-

|

500,000

|

(4)

|

-

|

$

|

3.40

|

1/19/2028

|

-

|

$

|

-

|

-

|

$

|

-

|

|||||||||||||||||||||

|

Francisco Silva

|

|

|

4,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

4/4/2021

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Francisco Silva

|

|

|

150

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

6/23/2021

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Francisco Silva

|

|

|

1,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

11/16/2021

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Francisco Silva

|

|

|

2,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

2/10/2022

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Francisco Silva

|

|

|

4,500

|

|

|

|

-

|

|

|

3,000

|

(5)

|

|

$

|

4.70

|

|

|

5/2/2022

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Francisco Silva

|

|

|

4,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

12/7/2022

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Francisco Silva

|

|

|

5,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

10/4/2023

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Francisco Silva

|

|

|

12,500

|

|

|

|

-

|

|

|

-

|

|

|

$

|

4.70

|

|

|

2/18/2024

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Francisco Silva

|

|

|

2,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

3/12/2024

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

||||||||||||||||||||||||||||||||||

|

Francisco Silva

|

|

|

37,500

|

|

|

|

-

|

|

|

-

|

|

|

$

|

4.70

|

|

|

10/23/2024

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Francisco Silva

|

25,000

|

-

|

-

|

$

|

4.70

|

9/4/2025

|

-

|

$

|

-

|

-

|

$

|

-

|

|

|||||||||||||||||||||

|

Francisco Silva

|

40,000

|

20,000

|

(6)

|

-

|

$

|

3.73

|

6/10/2026

|

-

|

$

|

-

|

-

|

$

|

-

|

|||||||||||||||||||||

|

Francisco Silva

|

26,667

|

53,333

|

(7)

|

-

|

$

|

2.80

|

7/12/2027

|

-

|

$

|

-

|

-

|

$

|

-

|

|||||||||||||||||||||

|

Francisco Silva

|

-

|

100,000

|

(8)

|

-

|

$

|

1.23

|

10/29/2028

|

-

|

$

|

-

|

-

|

$

|

-

|

|||||||||||||||||||||

|

Robert Paccasassi

|

|

|

5,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4.70

|

|

|

8/13/2025

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert Paccasassi

|

|

|

10,000

|

|

|

|

5,000

|

(9)

|

|

|

-

|

|

|

$

|

3.73

|

|

|

6/10/2026

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert Paccasassi

|

|

|

13,334

|

|

|

|

26,666

|

(10)

|

|

|

-

|

|

|

$

|

2.80

|

|

|

7/12/2027

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert Paccasassi

|

|

|

-

|

|

|

|

50,000

|

(11)

|

|

|

-

|

|

|

$

|

1.23

|

|

|

10/29/2028

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

In March 2019, the exercise price of each of the options was reduced to $0.75 per share.

|

|

(2)

|

Option is exercisable on June 23, 2019.

|

|

|

|

|

(3)

|

Option is exercisable to the extent of 91,667 shares on October 29, 2019 and 91,666 shares on October 29, 2020.

|

|

|

|

|

(4)

|

Option was exercisable subject to the satisfaction of a certain condition. As a result of Mr. Bergstein’s resignation on October 28,

2018, such option has terminated.

|

|

|

|

|

(5)

|

Options are exercisable commencing on the date (provided that such date is during Mr. Silva’s employment with us), if any, on which

either (i) the FDA approves a biologics license application made by us with respect to any biologic product or (ii) a 510(k) Premarket Notification submission is made by us to the FDA with respect to a certain device.

|

|

|

|

|

(6)

|

Option is exercisable on June 10, 2019.

|

|

|

|

|

(7)

|

Option is exercisable to the extent of 26,667 shares on July 12, 2019 and 26,666 shares on July 12, 2020.

|

9

|

(8)

|

Option is exercisable to the extent of 33,334 shares on October 29, 2019 and 33,333 shares on each of October 29, 2020 and October 29,

2021.

|

|

(9)

|

Option is exercisable on June 10, 2019.

|

|

(10)

|

Option is exercisable to the extent of 13,333 shares on each of July 12, 2019 and July 12, 2020.

|

|

(11)

|

Option is exercisable to the extent of 16,667 shares on each of October 29, 2019 and October 29, 2020 and 16,666 shares on October

29, 2021.

|

DIRECTOR COMPENSATION

The following table sets forth certain information concerning the compensation of our non-employee directors for the

fiscal year ended December 31, 2018:

|

Name

|

Fees Earned

or Paid in Cash

|

Stock Awards

|

Option

Awards (1)

|

Non-Equity

Incentive Plan Compensation

|

Nonqualified

Deferred Compensation Earnings

|

All Other Compensation |

Total

|

|||||||||||||||||||||

|

Robert B. Catell

|

$

|

40,000

|

$

|

-

|

$

|

79,600

|

(2)

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

119,600

|

|||||||||||||

|

John M. Desmarais

|

$

|

40,000

|

$

|

-

|

$

|

79,600

|

(3)

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

119,600

|

|||||||||||||

|

A. Jeffrey Radov

|

$

|

40,000

|

$

|

-

|

$

|

79,600

|

(4)

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

119,600

|

|||||||||||||

|

Charles S. Ryan

|

$

|

40,000

|

$

|

-

|

$

|

79,600

|

(5)

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

119,600

|

|||||||||||||

|

Paul Jude Tonna

|

$

|

40,000

|

$

|

-

|

$

|

79,600

|

(6)

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

119,600

|

|||||||||||||

____________________

|

(1)

|

The amounts reported in this column represent the grant date fair value of the option awards granted during the year ended December

31, 2018, calculated in accordance with FASB ASC Topic 718. For a detailed discussion of the assumptions used in estimating fair values, see Note 10 – Stockholders’ Deficiency in the notes that accompany our consolidated financial

statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 incorporated into this proxy statement by reference.

|

|

(2)

|

As of December 31, 2018. Mr. Catell held options for the purchase of 219,000 shares of common stock.

|

|

(3)

|

As of December 31, 2018, Mr. Desmarais held options for the purchase of 250,000 shares of common stock.

|

|

(4)

|

As of December 31, 2018, Mr. Radov held options for the purchase of 566,000 shares of common stock.

|

|

(5)

|

As of December 31, 2018, Dr. Ryan held options for the purchase of 256,000 shares of common stock.

|

|

(6)

|

As of December 31, 2018, Mr. Tonna held options for the purchase of 364,000 shares of common stock.

|

10

Each of Messrs. Catell, Desmarais, Radov and Tonna and Dr. Ryan, our non-employee directors, is entitled to receive, as

compensation for his services as a director, $30,000 per annum plus $10,000 per annum for all committee service, in each case payable quarterly (subject to our cash needs). Our non-employee directors also receive stock options, from time to time, in consideration of their services.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock, as of April 2,

2019, known by us, through transfer agent records, to be held by: (i) each person who beneficially owns 5% or more of the shares of common stock then outstanding; (ii) each of our directors; (iii) each of our Named Executive Officers (as defined

above); and (iv) all of our directors and executive officers as a group.

The information in this table reflects “beneficial ownership” as defined in Rule 13d-3 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”). To our knowledge, and unless otherwise indicated, each shareholder has sole voting power and investment power over the shares listed as beneficially owned by such shareholder, subject to community property

laws where applicable. Percentage ownership is based on 14,946,874 shares of common stock outstanding as of April 2, 2019.

|

Beneficial Owner

|

Number of Shares

Beneficially Owned

|

Approximate

Percent of Class

|

|

Dale Broadrick

3003 Brick Church Pike

Nashville, Tennessee

|

3,161,452 (1)

|

19.8%

|

|

John M. Desmarais

230 Park Avenue

New York, New York

|

2,029,574 (2)

|

12.3%

|

|

SCG Capital, LLC

Steven Geduld

21200 NE 38th Avenue

Aventura, Florida

|

1,573,485 (3)

|

9.99%

|

|

Westbury (Bermuda) Ltd.

Westbury Trust Victoria Hall 11 Victoria Street Hamilton, HMEX Bermuda |

1,151,661 (4)

|

7.6%

|

|

Mark Weinreb

40 Marcus Drive, Suite One Melville, New York |

1,124,501 (5)

|

7.0%

|

|

A. Jeffrey Radov

|

486,834 (6)

|

3.2%

|

|

Paul Jude Tonna

|

339,834 (7)

|

2.2%

|

|

Robert B. Catell

|

305,399 (8)

|

2.0%

|

|

Charles S. Ryan

|

251,001 (9)

|

1.7%

|

11

|

Francisco Silva

|

168,562(10)

|

1.1%

|

|

Robert Paccasassi

|

28,334(11)

|

*

|

|

Adam Bergstein

|

2

|

*

|

|

All directors and executive officers

as a group (10 persons) |

4,931,423(12)

|

25.8%

|

_____________________

|

*

|

Less than 1%

|

|

(1)

|

Based upon Schedule 13D filed with the Securities and Exchange Commission (the “SEC”). Includes 1,000,000 shares of common stock

issuable upon the exercise of currently exercisable warrants.

|

|

|

|

|

(2)

|

Based upon Schedule 13D filed with the SEC and other information known to us. Includes 1,536,176 shares of common stock issuable upon

the exercise of currently exercisable options and warrants (including warrants for the purchase of 40,000 shares of common stock held by a trust for which Mr. Desmarais and his wife serve as the trustees and which was established for the

benefit of his immediate family).

|

|

|

|

|

(3)

|

Based upon Schedule 13G filed with the SEC and other information known to us. Includes 803,728 shares of common stock issuable upon

the conversion of a currently convertible note and the exercise of currently exercisable warrants. The shares, convertible note and warrants are owned directly by SCG Capital, LLC, or SCG. Steven Geduld as President of SCG has an indirect

beneficial ownership in the securities held by SCG . SCG has rights, under a convertible promissory note, to own an aggregate number of shares of our common stock which, except for a contractual cap on the amount of outstanding shares of

the common stock that SCG may own, could exceed such a cap. SCG’s ownership cap under the convertible promissory note is 9.99% of the outstanding shares of our common stock. Therefore, based on 14,946,874 shares of common stock

outstanding as of April 2, 2019 (15,750,602 shares of common stock outstanding giving effect to the shares issuable pursuant to the warrants and the convertible note, subject to the cap), the number of shares of our common stock

beneficially owned by SCG as of April 2, 2019 was 1,573,485 shares of common stock.

|

|

(4)

|

Based upon Schedule 13D filed with the SEC and other information known to us. Includes 199,182 shares of common stock issuable upon

the exercise of currently exercisable warrants. The shares and warrants are owned directly by Westbury (Bermuda) Ltd. which is 100% owned by Westbury Trust.

|

|

(5)

|

Includes 1,044,501 shares of common stock issuable upon the exercise of currently exercisable options.

|

|

|

|

|

(6)

|

Includes 474,334 shares of common stock issuable upon the exercise of currently exercisable options.

|

12

|

|

|

|

(7)

|

Represents (i) 1,500 shares of common stock held jointly with Mr. Tonna’s wife and (ii) 303,834 shares of common stock issuable upon

the exercise of currently exercisable options and warrants.

|

|

|

|

|

(8)

|

Includes 224,533 shares of common stock issuable upon the exercise of currently exercisable options and warrants.

|

|

|

|

|

(9)

|

Includes 208,084 shares of common stock issuable upon the exercise of currently exercisable options and warrants.

|

|

|

|

|

(10)

|

Includes (i) 170 shares of common stock held in an individual retirement account for the benefit of Mr. Silva and (ii) 164,317 shares

of common stock issuable upon the exercise of currently exercisable options.

|

|

(11)

|

Represents shares of common stock issuable upon the exercise of currently exercisable options.

|

|

(12)

|

Includes 4,181,497 shares of common stock issuable upon the exercise of currently exercisable options and warrants.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

John M. Desmarais

In June 2016, we borrowed $500,000 from Tuxis Trust, a trust for which John M. Desmarais, one of our non-employee

directors and principal stockholders, and his wife serve as the trustees and which was established for the benefit of Mr. Desmarais’s immediate family. The promissory note evidencing the loan (the “Tuxis Trust Note”) provided for the payment of

the principal amount, together with interest at the rate of 10% per annum, in July 2017. In July 2017, we and Tuxis Trust agreed to amend the Tuxis Trust Note to provide for a maturity date of December 1, 2017 and an increase in the interest rate

to 15% per annum effective July 1, 2017. In the event that, prior to the maturity date of the Tuxis Trust Note, we receive net proceeds of $10,000,000 from a single equity or debt financing (as opposed to a series of related or unrelated

financings), Tuxis Trust has the right to require that we prepay the amount due under the Tuxis Trust Note (subject to the consent of the party that provided the particular financing). In consideration of the loan, we issued to Tuxis Trust a

five-year warrant for the purchase of 40,000 shares of our common stock at an exercise price of $4.00 per share.

In December 2016, we borrowed $60,000 from Mr. Desmarais. The promissory note evidencing the loan provided for the

payment of $65,000 on January 31, 2017. In consideration of the loan, we further extended the expiration dates of the warrants held by Mr. Desmarais for the purchase of 444,444 and 400,000 shares of our common stock to December 31, 2018. In

February 2017, we entered into an exchange agreement with Mr. Desmarais pursuant to which Mr. Desmarais exchanged the principal amount of the promissory note, together with accrued interest, for 21,731 shares of our common stock at an exchange

price of $3.00 per share and, in consideration thereof, received a five year warrant for the purchase of 21,731 shares of our common stock at an exercise price of $4.00 per share.

13

In July 2017, we borrowed $175,000 from Mr. Desmarais. The promissory note evidencing the loan (the “Desmarais Note”)

provides for the payment of the principal amount, together with interest at the rate of 15% per annum, on December 1, 2017. In the event that, prior to the maturity date of the Desmarais Note, we receive net proceeds of $10,000,000 from a single

equity or debt financing (as opposed to a series of related or unrelated financings), Mr. Desmarais has the right to require that we prepay the amount due under the Desmarais Note (subject to the consent of the party that provided the particular

financing). The payment of the Desmarais Note is secured by the grant of a security interest in our equipment and intellectual property. Concurrently, we agreed that the payment of the Desmarais Trust Note is also secured by the grant of such

security interest.

In November 2017, we and Mr. Desmarais agreed that the due date for the payment of the Desmarais Note was extended to

December 1, 2018. Concurrently, we agreed with Tuxis Trust that the due date for the payment of the Tuxis Trust Note was also extended to December 1, 2018. In consideration of the note extensions by Mr. Desmarais and Tuxis Trust, we agreed to

reduce the exercise prices of certain warrants held by Mr. Desmarais for the purchase of an aggregate of 775,000 shares of our common stock from $5.00 per share to $4.00 per share and the exercise price of a certain warrant held by Mr. Desmarais

for the purchase of 444,444 shares of our common stock from $4.50 per share to $4.00 per share.

In November 2018, we and Mr. Desmarais agreed that the due date for the payment of the Desmarais Note was extended to

December 31, 2019. Concurrently, we agreed with Tuxis Trust that the due date for the payment of the Tuxis Trust Note was also extended to December 31, 2019. In consideration of the note extensions by Mr. Desmarais and Tuxis Trust, we agreed to

reduce the exercise prices of certain warrants held by Mr. Desmarais for the purchase of an aggregate of 844,444 shares of our common stock from $4.00 per share to $1.50 per share and to extend the expiration date of such warrants from December 31,

2018 to December 31, 2019.

Others

In August 2016, we borrowed $100,000 from

Robert B. Catell, one of our non-employee directors. The promissory note evidencing the loan (the “Catell Note”) provided for the payment of the principal amount, together with interest at the rate of 10% per annum, on February 5, 2017. In

consideration of the loan, we issued to Mr. Catell a five-year warrant for the purchase of 8,000 shares of our common stock at an exercise price of $4.00 per share. In August 2017, we and Mr. Catell agreed that the outstanding principal amount of

the Catell Note of $50,000 will be payable on February 5, 2018. In consideration of such extension of the maturity date, we issued to Mr. Catell a five-year warrant for the purchase of 5,000 shares of our common stock at an exercise price of $4.00

per share. In April 2018, we and Mr. Catell agreed that the outstanding principal amount of the Catell Note of $45,000 will be payable on December 31, 2018. On February 8, 2019, we and Mr. Catell agreed that the outstanding principal amount of the

Catell Note of $30,000 will be payable on December 31, 2019. In the event that, prior to the maturity date of the Catell Note, we receive net proceeds of $10,000,000 from a single equity or debt financing (as opposed to a series of related or

unrelated financings), Mr. Catell has the right to require that we prepay the amount due under the Catell Note (subject to the consent of the party that provided the particular financing).

14

In December 2016, we borrowed $30,000 from Mr. Catell. The promissory note evidencing the loan provided for the payment

of $32,500 on January 31, 2017. In February 2017, we entered into an exchange agreement with Mr. Catell pursuant to which Mr. Catell exchanged the principal amount of the promissory note, together with accrued interest, for 10,866 shares of our

common stock at an exchange price of $3.00 per share and, in consideration thereof, received a five year warrant for the purchase of 10,866 shares of our common stock at an exercise price of $4.00 per share.

In February 2017, the Compensation Committee of our Board of Directors reduced the exercise price of outstanding options

for the purchase of an aggregate of 1,219,450 shares of our common stock (with exercise prices ranging between $5.70 and $30.00 per share) to $4.70 per share, which was the closing price for our common stock on the day prior to the determination,

as reported by the OTCQB. The exercise price reduction related to options held by, among others, our Named Executive Officers and directors with respect to the following number of shares: (i) Mark Weinreb, our President, Chief Executive Officer

and Chairman of the Board: 494,500 shares, (ii) A. Jeffrey Radov, one of our directors: 238,000 shares, (iii) Paul Jude Tonna, one of our directors: 100,000 shares, (iv) Dr. Charles S. Ryan, one of our directors: 35,000 shares, (v) Francisco

Silva, our Vice President of Research and Development: 100,650 shares, and (vi) Edward L. Field, then President of our Disc/Spine Division: 50,000 shares.

In March 2017, we entered into exchange agreements with Messrs. Catell, Desmarais, Ryan and Tonna, each a non-employee

director, pursuant to which accrued director fees were exchanged for our common stock at an exchange price of $3.00 per share and, in consideration thereof, we issued to them five year warrants for the purchase of our common stock at an exercise

price of $4.00 per share as follows: (i) Mr. Catell: $45,000 for 15,000 shares and 15,000 warrants; (ii) Mr. Desmarais: $50,000 for 16,667 shares and 16,667 warrants; (iii) Dr. Ryan: $80,000 for 26,667 shares and 26,667 warrants; and (iv) Mr.

Tonna: $90,000 for 30,000 shares and 30,000 warrants.

In August 2017,

we borrowed $125,000 from Robert Austin Sperling, Jr., one of our then principal stockholders. The promissory note evidencing the loan provided for the payment of the principal amount, together with interest at the rate of 12% per annum, on May

23, 2018. In the event that, prior to the maturity date of the note, we receive net proceeds of $10,000,000 from a single equity or debt financing (as opposed to a series of related or unrelated financings), Mr. Sperling has the right to

require that we prepay the amount due under the note (subject to the consent of the party that provided the particular financing). In consideration of the loan, we issued to Mr. Sperling a five-year warrant for the purchase of 15,000 shares of

our common stock at an exercise price of $4.00 per share.

In February 2019, we borrowed $450,000 from Harvey P. Alstodt and Melody Alstodt. The convertible promissory note issued to the lenders provides for the payment of the principal amount, together with interest at the rate of 15% per

annum, six months from the date of issuance. The note is convertible, at the option of the lenders, into shares of our common stock at a conversion price of $0.60 per share, subject to adjustment, and a five year warrant for the purchase of a

number of shares equal to the number of shares issued upon the conversion of the principal amount of the note. The warrant provides for an exercise price of $0.80 per share, subject to adjustment. The lenders are the parents of Lance Alstodt,

our Executive Vice President and Chief Strategy Officer.

15

In March 2019, our Board of Directors reduced the exercise price of outstanding options for the purchase of an aggregate

of 4,631,700 shares of our common stock (with exercise prices ranging between $1.00 and $4.70 per share) to $0.75 per share, which was the closing price for our common stock on the day prior to the determination, as reported by the OTCQB market.

The exercise price reduction related to options held by, among others, our Named Executive Officers and directors with respect to the following number of shares: (i) Mr. Weinreb: 1,319,500 shares, (ii) Mr. Radov: 566,000 shares, (iii) Mr. Tonna:

364,000 shares, (iv) Dr. Ryan: 256,000 shares, (v) Mr. Desmarais: 250,000 shares, (vi) Mr. Catell: 219,000 shares, (vii) Mr. Silva: 340,650 shares, and (viii) Robert Paccasassi, our Vice President of Quality and Compliance: 110,000 shares.

PROPOSAL 1: ELECTION OF DIRECTORS

Two Class II directors are to be elected at the meeting to serve until the 2022 annual meeting of

stockholders and until their respective successors shall have been elected and have qualified or until their earlier resignation or removal.

Nominees for Class II Director

Each nominee is currently a member of our Board of Directors. The following table sets forth each

nominee's age as of the date of the annual meeting, the positions and offices presently held with us, and the year in which he became a director.

|

Name

|

Age

|

Positions Held

|

Director Since

|

|

Paul Jude Tonna

|

60

|

Director

|

June 2014

|

|

John M. Desmarais

|

55

|

Director

|

December 2015

|

Paul Jude Tonna

Paul Jude Tonna became a member of our Board and Chair of our Compensation Committee in June 2014. Mr. Tonna is a highly

regarded community leader and an accomplished businessman with an extensive history of public service. From 1994 to 2005 he served as a Suffolk County, New York Legislator, and from 2000 through 2002 was its Presiding Officer. He currently serves

as Executive Director and a member of the Board of Advisors for The Energeia Partnership at Molloy College, a leadership academy based in Rockville Centre, New York, dedicated to identifying and addressing the serious, complex and multi-dimensional

issues challenging the Long Island region. Mr. Tonna is a former Adjunct Professor in Theology & Religious Studies at St. John’s University. He served as Chairman of the Suffolk County Industrial Development Agency, and currently serves as

Trustee of the Long Island State Parks & Recreation Commission and as Public Trustee of the Stationary Engineers Industry Stabilization Fund. Mr. Tonna is a board member of The Advanced Energy Research & Technology Center at Stony Brook

University, The Long Island Index Advisory Board and Erase Racism’s College of Advisors. He also serves as the Executive Director of the Suffolk County Village Officials Association and the United States Green Building Council-Long Island Chapter.

Mr. Tonna is a founding director of Empire National Bank and Chairman and Commissioner of the South Huntington Water District. Mr. Tonna holds an undergraduate degree in Philosophy from New York University and a Master’s degree in Theology from

Immaculate Conception Seminary, and he conducted doctoral studies in Systemic Theology at Fordham University. We believe that Mr. Tonna’s executive-level management experience and his extensive experience in the Long Island community give him the

qualifications and skills to serve as one of our directors.

16

John M. Desmarais

John M. Desmarais became a member of our Board of Directors in December 2015. Mr. Desmarais is the founding partner of

Desmarais LLP, an intellectual property trial boutique established in 2010, and the founder and owner of Round Rock Research LLC, and Sound View Innovations LLC, patent licensing companies. From 1997 to 2009, he was a partner at the international

law firm of Kirkland & Ellis LLP and served as a member of the firm’s Management Committee from 2004 to 2009. Prior to joining Kirkland, and after practicing in the area of intellectual property litigation and counseling for several years, he

left private practice to serve as an Assistant United States Attorney in the Southern District of New York, where for three years he represented the federal government in criminal jury trials. Mr. Desmarais is a member of the bars of California,

New York and Washington, D.C., the United States Supreme Court, the Federal Circuit Court of Appeals, and various other federal district courts and courts of appeal. He is also registered to practice before the United States Patent and Trademark

Office. Mr. Desmarais has been recognized by numerous publications as one of the nation’s leading intellectual property litigators. Mr. Desmarais obtained a degree in Chemical Engineering from Manhattan College and a law degree from New York

University. We believe that Mr. Desmarais’ business and legal experience, including his extensive experience in the area of intellectual property, give him the qualifications and skills to serve as one of our directors.

Directors Not Standing For Election

|

Name

|

Age

|

Positions Held

|

Director Since